You’ve opened your trading platform, charts flickering with potential. You see EUR/USD move from 1.1050 to 1.1055. You know that’s a good thing if you’re buying, but how good? How much money did that tiny movement actually make or cost you? You feel a knot of confusion. Terms like “pips,” “lots,” and “profit calculation” swirl in your head, turning the exciting world of forex into a frustrating puzzle. You’re not alone. Every successful trader started right where you are—staring at the numbers, trying to decode the fundamental language of the market. That foundational unit, the very heartbeat of every price change, is the pip. Understanding it isn’t just technical jargon; it’s the key to unlocking control, precision, and ultimately, confidence in your trading.

The Pain: Lost in Translation in a World of Numbers

Imagine trying to build a house without knowing what a centimetre or an inch is. You couldn’t measure materials, plan spaces, or communicate with contractors. In forex trading, not understanding a pip is exactly that. It leads to a cascade of frustrations:

- Unquantified Risk: You enter a trade but have no real grasp of how much each price fluctuation impacts your capital. Is a 10-point move trivial or catastrophic?

- Clouded Profit Goals: Setting a “50-point target” is meaningless if you don’t know what that translates to in your account currency.

- Strategy Confusion: Trading systems often say, “Place a stop-loss 20 pips away.” Without mastery of the pip, you’re blindly following instructions, not applying a strategy.

- Broker Statement Anxiety: Looking at your profit/loss statement feels like reading a foreign language, eroding trust in your own actions.

This pain stems of trading platform from a disconnect between the abstract movement on the chart and the very real money in your account. Bridging that gap starts with one simple concept.

The Logic: Demystifying the Pip – Your Ruler for the Market

Let’s replace confusion with clarity. A pip, which stands for “Percentage in Point” or “Price Interest Point,” is the standard unit for measuring how much an exchange rate has changed. It’s the smallest whole-unit move a currency pair can make, based on market convention.

The Classic Definition: Pip in Major Pairs

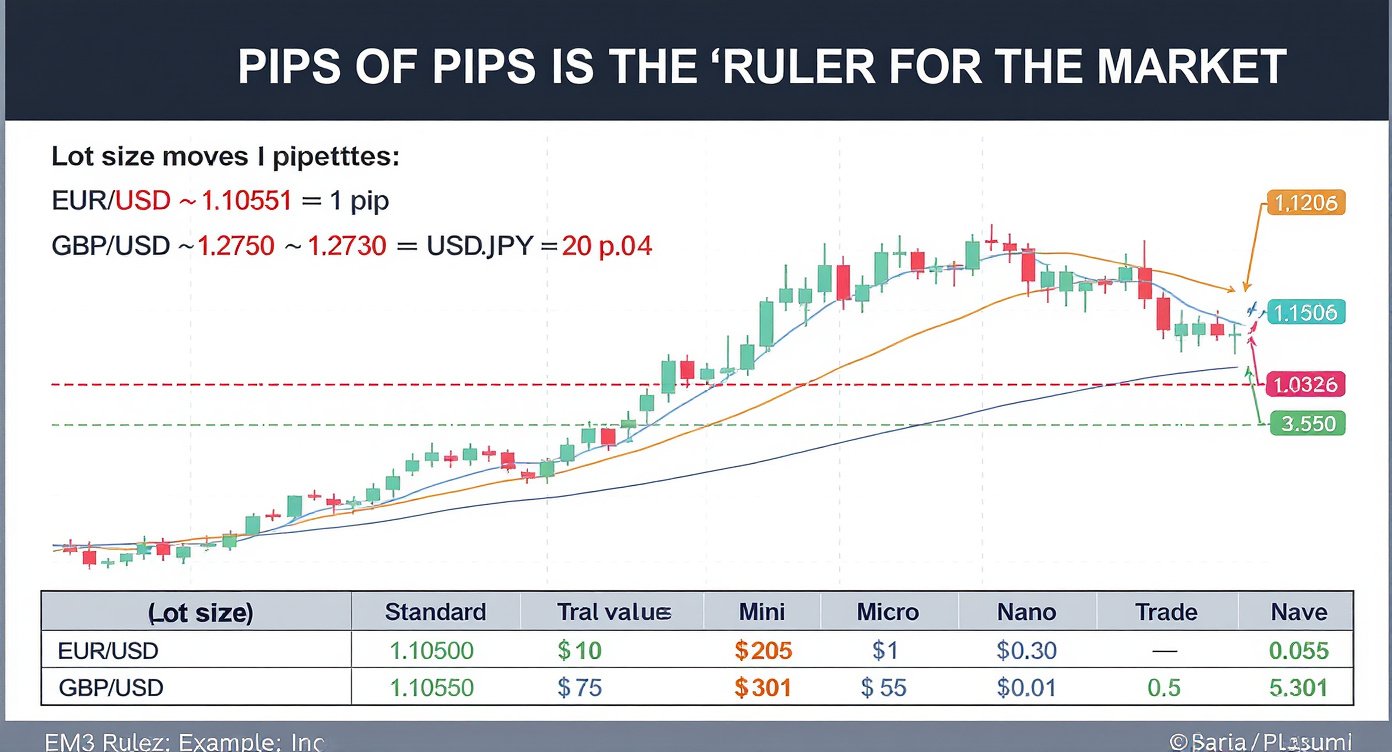

For most major currency pairs (like EUR/USD, GBP/USD, USD/JPY), a pip is traditionally represented by the fourth decimal place in the exchange rate.

- If EUR/USD moves from 1.1050 to 1.1051, it has moved 1 pip.

- If GBP/USD falls from 1.2750 to 1.2730, it has fallen 20 pips.

The exception is any pair involving the Japanese Yen (JPY), where a pip is the second decimal place because the Yen is valued much lower relative to the dollar.

- If USD/JPY moves from 150.00 to 150.05, it has moved 5 pips.

The Modern Evolution: Fractional Pips (Pipettes)

With the demand for more precise pricing, most brokers now quote an extra decimal place. This fractional pip is called a “pipette.“ One pip equals 10 pipettes.

- A move from EUR/USD 1.10500 to 1.10505 is a move of 5 pipettes, or 0.5 pips.

Calculating the Value of a Pip: From Abstract to Concrete

This is where logic meets your wallet. The monetary value of a pip depends on three factors: the currency pair, the size of your trade (lot size), and your account currency.

The standard formula for a quote currency (the second currency in the pair) that is NOT your account currency is:

Pip Value = (0.0001 / Exchange Rate) x Lot Size (in units)

But let’s simplify with a universal tool: the Lot Size Table.

| Lot Size | Units Traded | Standard Pip Value (for EUR/USD, GBP/USD, etc.)* | Typical Account Size Suitability |

|---|---|---|---|

| Standard Lot | 100,000 units | $10 per pip | Large/Institutional |

| Mini Lot | 10,000 units | $1 per pip | Intermediate |

| Micro Lot | 1,000 units | $0.10 per pip | Beginner (Most Common Start) |

| Nano Lot | 100 units | $0.01 per pip | Very Small Account / Precision Testing |

*For pairs where USD is the quote currency (second). Value changes if USD is the base currency or not involved.

Practical Calculation Example:

You trade a mini lot (10,000 units) of EUR/USD.

- Pip Value = (0.0001 / 1) * 10,000 = $1 (Since the quote currency is USD, it’s straightforward).

- If your trade gains 45 pips, your profit is: 45 pips * $1/pip = $45.

You trade a micro lot (1,000 units) of GBP/USD.

- Pip Value ≈ $0.10 (as per table).

- A 30-pip stop-loss would mean a predefined risk of: 30 pips * $0.10 = $3</strong