If you are an Indian expat living in Kuwait, your monthly routine likely revolves around one number: the exchange rate. Converting Kuwait Money to Indian Money is not just about a simple transaction. It is about maximising your hard-earned savings. For years, the Kuwaiti Dinar has remained the strongest currency in the world, often leaving many wondering how to get the most out of their transfers.

Today, we see significant shifts in the global financial market. Whether you are sending money for family support, investments, or savings, knowing the live KWD to INR today rate is your first step toward financial efficiency. We understand the pressure of finding a reliable service that offers both speed and transparency.

In this guide, we break down everything you need to know about the current Kuwait to India exchange rate. We will look at why rates change, which apps are leading the market in 2026, and how you can avoid hidden fees that eat into your remittance.

Understanding the KWD to INR Today Live Rate

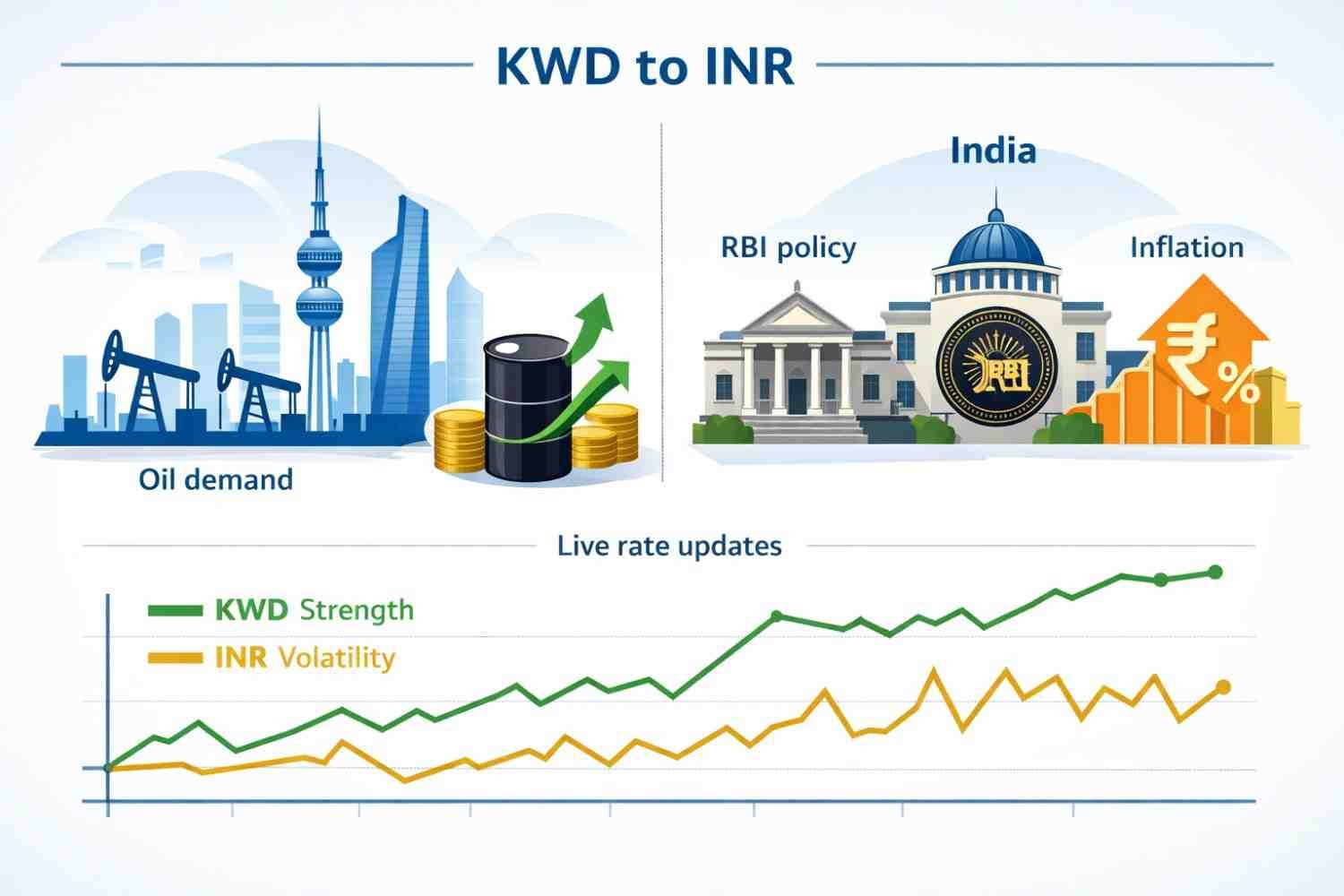

The exchange rate for Kuwait Money to Indian Money is influenced by oil prices, trade balances, and central bank policies. As of early 2026, the Kuwaiti Dinar continues its reign as a powerhouse. When you check the KWD to INR calculator, you aren’t just looking at a static number. You are looking at a dynamic market value.

Currently, 1 KWD hovers around the 300 INR mark, a milestone that has changed the way many expats plan their monthly transfers. This high valuation means that even a minor fluctuation of 0.05% can result in a difference of thousands of rupees on large transfers.

We recommend monitoring the market during mid-week sessions. Historically, Tuesday and Wednesday often show more stability compared to the volatile openings on Sunday or the closing hours on Thursday. Keeping a close eye on the Kuwait remittance to India trends allows you to strike when the iron is hot.

Top Options for Kuwait Remittance to India in 2026

When you decide to move your money, the platform you choose is just as important as the rate itself. The days of waiting in long lines at exchange houses are fading. Digital-first solutions now dominate the landscape of Kuwait to India exchange rate providers.

Al Mulla Exchange

Al Mulla remains a household name for Indians in Kuwait. Their mobile app has seen massive updates in 2026, offering near-instant credits to major Indian banks like SBI, HDFC, and ICICI. They often provide competitive rates that closely track the mid-market price.

Al Ansari Exchange

With a vast network of physical branches and a robust digital platform, Al Ansari is a reliable choice for those who prefer a mix of traditional and modern banking. Their transparency regarding fees is a major plus for anyone sending to Kuwait from India.

Wise and Western Union

For those looking for purely digital paths, Wise offers some of the lowest “real-market” rates. Western Union remains the king of reach, especially if your recipient needs to pick up cash in a rural part of India.

How to Use a KWD to INR Calculator Effectively

A KWD to INR calculator is more than just a tool to see your total. It is a comparison engine. Before you hit “send” on any app, use an independent calculator to verify the mid-market rate.

Most remittance apps bake a “margin” into their exchange rate. This is essentially a hidden fee. If the market rate is 300.50 but your app shows 298.20, you are paying a significant premium. We suggest checking the rate on at least three different platforms before committing.

You can also explore our guide on used mobiles in Kuwait to save more money locally, allowing you to remit even more to India. Every Dinar saved in Kuwait is hundreds of Rupees added to your Indian bank account.

Best Money Transfer Kuwait India: What to Look For

Finding the best money transfer Kuwait India service requires a balance of three factors: speed, cost, and security. In 2026, “instant” is the new standard. If a service takes more than 24 hours to credit an Indian bank account, it is likely outdated.

- Transaction Fees: Some services charge a flat fee, while others take a percentage. For small amounts, a flat fee might be expensive. For large sums, a percentage can be devastating.

- Transfer Speed: Unified Payments Interface (UPI) integration has changed the game. Many Kuwaiti exchange houses now allow direct transfers to UPI IDs, which are often instant.

- Regulatory Compliance: Always ensure the provider is licensed by the Central Bank of Kuwait. This protects your funds against fraud and ensures your Kuwait remittance to India is legal.

Factors Influencing the Kuwait to India Exchange Rate

Why does the rate for Kuwait Money to Indian Money fluctuate so much? Several macroeconomic factors are at play. First, Kuwait’s economy is heavily tied to petroleum exports. When global oil demand rises, the Dinar strengthens.

Second, the Reserve Bank of India (RBI) policies affect the Rupee. If inflation in India is high, the Rupee may depreciate against the Dinar, giving you more value for your transfer. In 2026, we have seen the Indian economy show resilience, but the sheer strength of the Dinar’s peg to a basket of currencies keeps it at the top of the chart.

Understanding these trends helps you decide whether to send money today or wait for a potential peak next week. For the most accurate data, always search for KWD to INR today’s live updates.

Step-by-Step Guide to Sending Money from Kuwait to India

If you are new to the expat life, sending your first remittance can feel overwhelming. Follow this simple process to ensure your Kuwait Money to Indian Money arrives safely:

- Verify the Recipient Details: Double-check the IFSC code and account number. A single wrong digit can lead to weeks of stress.

- Compare the Rates: Use a KWD to INR calculator to see which app gives the highest Rupee value.

- Check for Promos: Many apps offer “zero-fee” first transfers for new users. Take advantage of these.

- Keep the Receipt: Digital or physical, always save your transaction reference number. It is your only proof if the transfer gets delayed.

For more information on international financial standards, you can visit the Reserve Bank of India website for official remittance guidelines.

Strategies for Timing Your Remittance

Timing is everything. Sending money on the 1st of the month, when everyone gets paid, can sometimes lead to slightly lower rates due to high demand. If possible, wait until the second week of the month.

Many savvy expats set “Rate Alerts” on their phones. When the Kuwait to India exchange rate hits a certain target, they receive a notification and execute their transfer immediately. This proactive approach can save you a lot over the year.

The Future of KWD to INR Transfers in 2026

The landscape of Kuwait remittances to India is becoming more decentralised. We are seeing more blockchain-based pilots that aim to reduce the settlement time to seconds while cutting fees to nearly zero. While traditional banks are still used for very large transfers (like property purchases), apps are winning the daily battle for the “searcher” who wants convenience.

We expect the Dinar to remain stable throughout 2026. The bilateral trade between India and Kuwait is at an all-time high, ensuring that the corridors for money flow remain open and efficient.

Conclusion

Maximising your Kuwait Money to Indian Money conversion is a skill that pays off every single month. By staying informed about the KWD to INR today rate and choosing the best money transfer Kuwait India options, you protect your financial future. Don’t just settle for the first exchange house you see at the mall. Use the digital tools available to compare, track, and save.

Your hard work in Kuwait deserves the best possible return when it reaches home in India. Stay diligent, use a reliable KWD to INR calculator, and always prioritise security over a slightly better rate from an unknown provider.

Frequently Asked Questions

What is the best way to send money from Kuwait to India?

The best way is usually through a digital exchange app like Al Mulla or Al Ansari, as they offer better rates than traditional banks and faster processing times.

How much money can I send from Kuwait to India?

While there is no strict limit from the Kuwait side for personal remittances, large amounts may require documentation regarding the source of funds to comply with Anti-Money Laundering (AML) laws.

Does the KWD to INR rate change on weekends?

The official forex market is closed on weekends, but many exchange houses in Kuwait update their rates based on the last closing price or predicted market openings.

Are there hidden fees in KWD to INR transfers?

Yes, many providers hide fees in the “exchange rate margin.” This is the difference between the mid-market rate and the rate they offer you.

Can I send money from Kuwait to an Indian UPI ID?

Yes, many modern remittance services now support direct transfers to UPI IDs, making the process much faster for the recipient.