Forex Trading in Japan: An In-Depth Guide

Key Takeaways

- Forex trading is legal and regulated in Japan.

- Japan has seen a surge in interest towards forex trading, becoming an active trading community.

- Understanding the market’s regulatory framework is essential for traders.

- Key players in the forex market include domestic brokers and financial institutions.

- Risks and tax responsibilities need careful consideration for forex traders.

Table of contents

- Grasping the Basic Concepts of Forex Trading

- Delving into Forex Trading in Japan: The Scene, Players, and Drivers

- Deciphering the Legal Scene of Forex Trading in Japan

- Legalities of Forex Trading in Japan: The Current Status and Recent Updates

- Regulatory Bodies Governing Forex in Japan: Their Roles and Responsibilities

- Understanding Forex Trading Timings in Japan: Best Hours and Market Strategy

- Identifying the Ideal Forex Broker in Japan: Importance of Compliance and Regulation

- Advantages of Forex Trading in Japan: Economic Factors, Investor Support, and Education

- Understanding Risks of Forex Trading in Japan: Common Hazards, Regulatory Constraints, and Risk Management

- Tax Responsibilities for Forex Traders in Japan: Taxation, Compliance, and Advice

Forex trading in Japan has undergone considerable expansion in recent times, making it an attractive prospect for market players. Known as the planet’s largest and most liquid financial market, forex trading is the process of buying and selling various currencies to benefit from changes in their exchange rates. This energetic market operates 24/7, connecting players from all over the world and modifying itself in response to economic developments and advancements in technology [Comprehensive Forex Trading: An In-Depth Guide to Navigating Japan’s Forex Market].

In the past few years, Japan is witnessing a considerable increase in interest towards forex trading. The involvement of both individuals and institutions are pushing the nation towards becoming one of the world’s most active trading communities. Tokyo’s status as a crucial forex trading hub further boosts Japan’s standing in this market. Having a thorough understanding of the regulatory framework, market trends, and local trading nuances is essential for anyone seeking to engage in forex trading in Japan. This blog aims to give an in-depth overview of the legality, trading timings, broker selection process, advantages, hazards, and tax implications of forex trading in Japan [Expanded Possibilities: Japan’s Forex Market].

1. Grasping the Basic Concepts of Forex Trading

The A to Z of Forex Trading

Forex trading or foreign exchange trading involves the purchase and sale of currencies. Traders invest in pairs of currencies like USD/JPY, where the U.S. Dollar is the base currency, and the Japanese Yen is the quote currency, aiming to profit from alterations in exchange rates. This trading market is famous for its high liquidity and accessibility [An Introduction to Forex Trading: Understanding the Basics].

Operation of the Global Forex Market

The forex market operates in a decentralized fashion, conducted over-the-counter (OTC) through computer networks, with no central exchange. This allows it to function throughout the day and night, split into major trading sessions: Tokyo, London, and New York [Trading in the Land of the Rising Sun: A Forex Guide to Japan].

Factors Influencing the Forex Market

Several aspects influence forex markets, including economic indicators such as interest rates, inflation, GDP reports, and employment data. Political events like elections and policy changes also impact currency values, as do geopolitical tensions. [TradingPedia – Japan Forex Brokers]

2. Delving into Forex Trading in Japan: The Scene, Players, and Drivers

Rise in Popularity and Current Trends

The popularity of forex trading in Japan has grown remarkably in recent years [Factors Influencing Forex Markets in Japan].

Key Players in Japan’s Forex Market

Japan’s forex market brings together domestic and foreign brokers. Major domestic brokers provide comprehensive services, while financial institutes and banks also play substantial roles by offering liquidity and access to the market. [Forex Trading in Japan: Unpacking Economic Impact, Market Risks, and Lucrative Opportunities]

Drivers of Forex Trading in Japan

Several factors make forex trading attractive in Japan, including an advanced digital infrastructure and robust regulatory oversight ensuring safety and trust. The population has a higher level of financial literacy, making them informed about economic developments and investment possibilities. Interest in global markets and varied investment avenues further propels forex trading as a popular and feasible activity [Forex Trading Robots in Japan: A Revolution in Trading].

3. Deciphering the Legal Scene of Forex Trading in Japan

Explaining the Legality in Detail

Forex trading is entirely legal in Japan, controlled by the Foreign Exchange and Foreign Trade Act (FEFTA). This framework outlines the licensing, reporting requirements, and enforcement protocols for forex transactions [Forex Trading in Japan: A Comprehensive Guide].

Historical Overview of Forex Regulations in Japan

Forex regulations in Japan have evolved to a great extent over the years, with authorities refining rules to enhance transparency and protect investors [Trading in the Land of the Rising Sun: A Forex Guide to Japan].

Emphasis on Transparency and Investor Protection by Regulatory Bodies

Japanese regulations prioritize transparency and protect investors from fraud and wrongful practices. Brokers are required to maintain segregated accounts for client funds and adhere to stringent compliance requirements. Such measures prevent conflicts of interest, ensuring brokers act in the best interest of their clients [An In-depth Guide on Forex Trading in Japan].

4. Legalities of Forex Trading in Japan: The Current Status and Recent Updates

Directly Addressing the Main Question

Yes, forex trading in Japan is legal and regulated by FEFTA and overseen by JFSA [Trading in the Land of the Rising Sun: A Forex Guide to Japan].

Review of Any Recent Legal Changes or Updates

Recent updates such as the amendments to the Foreign Exchange Order in 2025 reflect Japan’s aim to strengthen the integrity and security of the market [Forex Trading in Japan: A Comprehensive Guide].

Understanding Compliance Requirements

All forex brokers in Japan must hold a license from JFSA and comply with comprehensive regulatory requirements [Expanded Possibilities: Japan’s Forex Market].

5. Regulatory Bodies Governing Forex in Japan: Their Roles and Responsibilities

Glimpse of Financial Regulators in Japan

The Financial Services Agency (JFSA) is the chief regulatory body supervising the forex market in Japan [An Introduction to Forex Trading: Understanding the Basics].

Analyzing the Roles and Responsibilities of the JFSA

The JFSA is responsible for licensing and regulating forex brokers in Japan. It ensures that brokers adhere to strict compliance standards, including segregated client accounts and robust reporting requirements. Enforcement measures uphold market integrity, shielding traders from wrongful practices [Forex Trading in Japan: Unpacking Economic Impact, Market Risks, and Lucrative Opportunities].

Self-Regulatory Organizations (SROs)

The Japan Exchange Regulation (JPX-R) maintains market integrity by conducting inspections and audits [Comprehensive Forex Trading: An In-Depth Guide to Navigating Japan’s Forex Market].

6. Understanding Forex Trading Timings in Japan: Best Hours and Market Strategy

Identifying Optimal Trading Hours for Japanese Traders

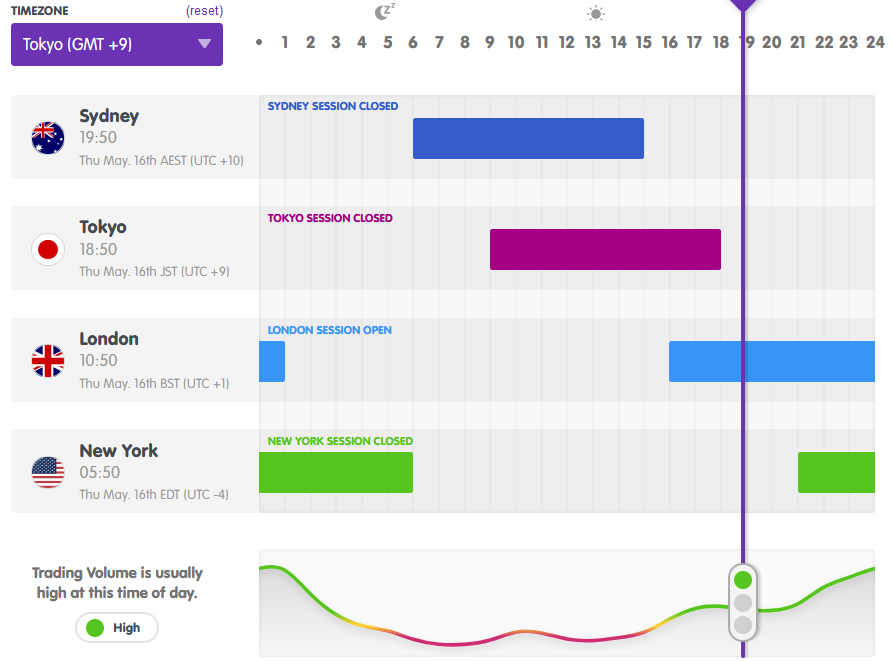

In Japan, the optimal trading hours correlate to the Tokyo session, from 9:00 AM to 6:00 PM Japan Standard Time (JST) [An In-depth Guide on Forex Trading in Japan].

Influence of Time Zones on Trading Strategies

Japanese traders benefit from the overlap between the Tokyo and London sessions, which provides increased liquidity and significant trading volumes [Expanded Possibilities: Japan’s Forex Market].

Tailoring Trading Strategies to Suit Time Zones

Traders can modify their strategies to suit their preferred trading times and market conditions [Trading in the Land of the Rising Sun: A Forex Guide to Japan].

7. Identifying the Ideal Forex Broker in Japan: Importance of Compliance and Regulation

Setting Criteria for Broker Selection

When evaluating forex brokers in Japan, consider their regulatory compliance, transparency, and customer service as crucial factors [Factors Influencing Forex Markets in Japan].

Highlighting the Importance of Compliance and Regulation

Ensuring that brokers comply with Japanese regulations is essential for safe trading. Unlicensed brokers pose significant risks, including exposure to fraud and lack of legal recourse [Trading in the Land of the Rising Sun: A Forex Guide to Japan].

8. Advantages of Forex Trading in Japan: Economic Factors, Investor Support, and Education

Discussing Advantages Specific to the Japanese Market

The Japanese market boasts a strong regulatory framework, providing a safe environment for forex trading. Access to advanced trading technologies and highly liquid JPY currency pairs add to the charm [Forex Trading Robots in Japan: A Revolution in Trading].

Economic Factors Favoring Forex Trading

Japan’s role as a global financial center, anchored by Tokyo, enhances market activity and opportunities [Trading in the Land of the Rising Sun: A Forex Guide to Japan].

Role of Investor Support and Education

Japanese traders have access to a plethora of educational resources provided by brokers and financial institutions [An In-depth Guide on Forex Trading in Japan].

9. Understanding Risks of Forex Trading in Japan: Common Hazards, Regulatory Constraints, and Risk Management

Identifying Common Risks Faced by Japanese Traders

Forex trading in Japan involves risks such as market volatility and losses induced by leverage [Forex Trading in Japan: Unpacking Economic Impact, Market Risks, and Lucrative Opportunities].

Tips to Manage and Mitigate Risks

Traders can manage risks by using effective risk management techniques such as using stop-loss and take-profit orders [Factors Influencing Forex Markets in Japan].

10. Tax Responsibilities for Forex Traders in Japan: Taxation, Compliance, and Advice

Understanding Tax Responsibilities

Profits from forex trading in Japan are taxable income, and traders must report earnings to the National Tax Agency [Forex Trading in Japan: Unpacking Economic Impact, Market Risks, and Lucrative Opportunities].

Explaining How Profits from Forex Trading are Taxed

Forex trading profits are subject to income tax and habitant tax [Expanded Possibilities: Japan’s Forex Market].

Importance of Adherence to Guidelines

Maintaining accurate trading records and following tax laws is crucial for compliance [Forex Trading Robots in Japan: A Revolution in Trading].

Conclusion

With the rise in curiosity towards forex trading in Japan, understanding the legal backdrop, regulatory framework, and distinct market characteristics is essential. Staying informed and selecting reputable, compliant brokers allows traders to navigate the complexities of forex trading in Japan with confidence. Engaging in forex trading in Japan offers promising opportunities for those who are prepared and knowledgeable; it’s a feasible avenue for financial growth in one of the world’s most vibrant markets.

Prospective participants are advised to take calculated steps towards forex trading by educating themselves, opening a demo trading account to practice and hiring financial advisors or experienced traders. Cautious and strategic engagement in forex trading enables traders to utilize the myriad opportunities in the Japanese forex market while effectively managing risks [Forex Trading in Japan: Unpacking Economic Impact, Market Risks, and Lucrative Opportunities].