An In-depth Guide on Forex Trading in Japan

Key Takeaways

- Understanding Japan’s Forex Market is crucial to navigating its unique opportunities.

- The regulatory framework ensures a safe trading environment for participants.

- Market timings play a significant role in developing effective trading strategies.

- Utilizing advanced technologies can enhance trading capabilities.

- Identifying challenges and opportunities is key for successful trading in Japan.

Table of contents

- Understanding the Mechanics of the Forex Market in Japan

- Navigating the Regulatory Framework of Forex Trading in Japan

- The Authorities Governing Forex Trading in Japan

- When is the Best Time to Trade Forex in Japan?

- Becoming a Pro Trader: Exploring Tools and Platforms for Forex Trading in Japan

- Identifying Challenges and Seizing Opportunities in Japanese Forex Trading

- Readying for Future Trends in Forex Trading in Japan

- Final Word: Making Sense of Forex Trading in Japan

- Frequently Asked Questions

The journey through the world of forex trading in Japan can feel overwhelming, yet it is rich with potential. This guide aims to unpack the layers of complexities, focusing on essential components that define forex trading in one of the world’s most dynamic markets.

Understanding the Mechanics of the Forex Market in Japan [Expanded Possibilities: Japan’s Forex Market]

Getting to Grips with the Japanese Forex Market

The Japanese forex market is not a lone entity, but a vital node in a decentralized global arena where currencies are exchanged.

The Main Players in the Market

The forex market in Japan is vibrant and diverse thanks to a variety of participants, including large institutions and individual traders.

Decoding Tokyo’s Forex Market

Why is Tokyo’s forex market unique? Find out the effect of Single Dealer Platforms (SDPs) on spot transactions.

The Economic Influencers of Forex Trading in Japan [Factors Influencing Forex Markets in Japan]

Economic indicators and interest rates play crucial roles in shaping the forex market in Japan.

Navigating the Regulatory Framework of Forex Trading in Japan

Deciphering the Legalities of Forex Trading

Forex trading is legal in Japan, and is facilitated by clear guidelines that are in place to safeguard traders.

How does Japan Regulate Forex Trading?

An overview of the stringent regulatory environment that oversees forex trading in Japan.

Japan’s Forex Regulations vs the Rest of the World

Find out how Japan’s rigorous regulatory standards fare when compared to other countries.

The Authorities Governing Forex Trading in Japan

Meet the Financial Services Agency (FSA)

Learn about the role of the FSA in maintaining oversight on Japan’s forex trading activities.

The Role of the Japan Forex Dealers Association (JFDA)

JFDA has a specialized role in monitoring forex dealers and setting guidelines that promote safety.

The Licensing Process for Forex Brokers in Japan

Ever wondered what steps brokers need to take to operate in Japan? Check this section to find out.

How are Traders Protected?

Japan employs several mechanisms to ensure a secure trading environment for all market participants.

When is the Best Time to Trade Forex in Japan?

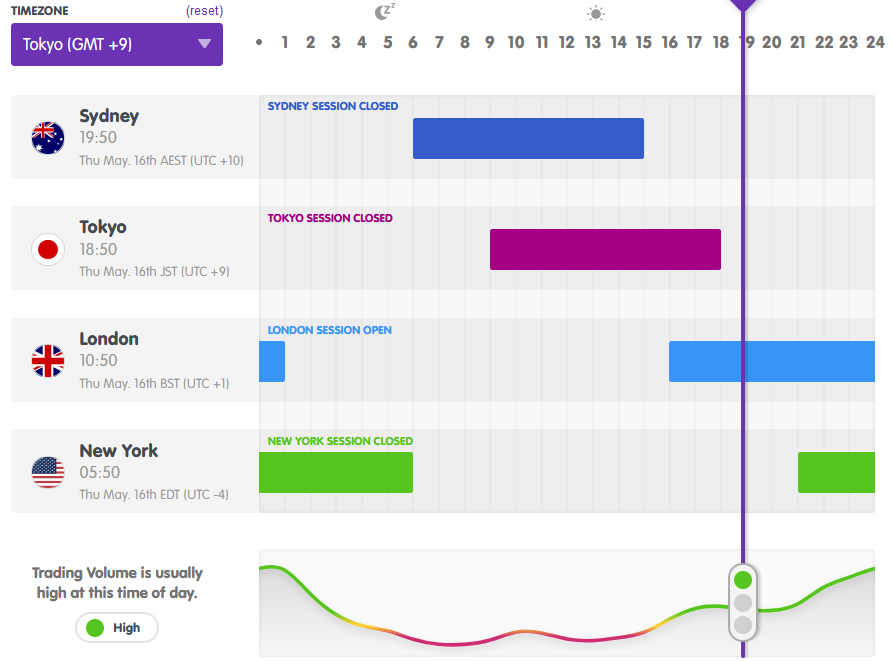

Mastering the Forex Trading Hours

Understanding the trading hours can be beneficial in optimizing your trading strategy.

Aligning with International Market Timings

Aligning your trades with global market timings can potentially increase your profits.

Adapting Your Trading Strategy to Market Timings

The best trading strategies factor in market hours and their impact on various currency pairs.

Becoming a Pro Trader: Exploring Tools and Platforms for Forex Trading in Japan

Choosing the Right Trading Platform

Explore popular trading platforms like MetaTrader that are equipped with Japanese language support.

Equip Yourself with Essential Trading Tools

Incorporate indispensable tools like real-time charting, economic calendars, and risk management tools in your trading process.

Embrace Technology in Forex Trading [Trading in the Land of the Rising Sun: A Forex Guide to Japan]

Discover how electronic forex trading (e-FX) and advanced technologies can enhance your trading capabilities.

Identifying Challenges and Seizing Opportunities in Japanese Forex Trading

The Roadblocks on the Trading Path

Forex trading in Japan presents some challenges that traders need to overcome.

Spotting Opportunities in the Forex Market

Exploring the growth potential of Japan’s forex market and identifying the avenues for profit.

Strategies to Overcome Challenges

Equip yourself with knowledge on tackling challenges that might arise in your trading journey.

Readying for Future Trends in Forex Trading in Japan

Spotting the Emerging Trends

From e-FX expansion, integration of AI and machine learning, to mobile trading, stay ahead with the latest trends.

Making Market Predictions

Projected growth rate and the impact of economic policies on the trading dynamics.

Navigating the Impact of Japanese Stock Market

Learn how the Nikkei 225 and foreign investment shape the forex trading market.

Future-proofing Your Trading Operation

Staying informed and adopting new technologies are critical in preparing for the future of forex trading in Japan.

Final Word: Making Sense of Forex Trading in Japan

Recap the Essential Points

From learning about the legality and market dynamics to exploring trading tools and future advancements, forex trading in Japan offers lucrative opportunities.

Leaving You with Some Final Thoughts

While the Japanese forex market presents a promising landscape, continually enhancing one’s skills and adapting to changing conditions are key.

Call to Action: Your Trading Journey Begins

To all the aspiring traders out there, here is your chance to embark on a potentially successful journey in Japan’s dynamic forex market.

Frequently Asked Questions

What makes Japan a good market for forex trading?

Japan’s stable economy and advanced technology infrastructure make it a favorable trading environment.

How can I start trading forex in Japan?

Starting with thorough research followed by selection of a licensed broker is essential for initiating your trading journey.

What are the typical trading hours for the Japanese forex market?

The Japanese forex market operates 24 hours a day, aligned with the major global forex markets.

How do regulations impede or aid trading in Japan?

Regulations protect traders and ensure market integrity, although they may impose constraints on leverage and trading practices.