You stare at the screen, a dizzying array of numbers, charts, and financial jargon swirling before your eyes. The promise of trading from anywhere in the world, of tapping into a market that never sleeps, is incredibly alluring. Yet, for every story of success, there seems to be a whisper of significant loss. You feel stuck—paralysed by the complexity, fearful of losing your hard-earned money, and unsure where to even begin. This gap between ambition and action, between desire and knowledge, is the silent pain point for every aspiring forex trader. You’re not just looking for a “get-rich-quick” scheme; you’re seeking a legitimate skill, a way to understand the financial pulse of the planet and potentially profit from it. This guide is designed to bridge that gap.

The Pain: Lost in a $7.5 Trillion Daily Storm

The foreign exchange (forex) market is the largest and most liquid financial market globally, with a daily trading volume exceeding $7.5 trillion. Yet, for the individual, it can feel overwhelmingly vast and impersonal. The common pains are real:

- Information Overload: Conflicting advice from forums, YouTube gurus, and expensive courses leaves you more confused than when you started.

- Analysis Paralysis: Should you use technical analysis, fundamental analysis, or a blend of both? The tools and indicators are endless.

- Emotional Whiplash: The thrill of a winning trade can quickly turn into the despair of a loss, leading to impulsive decisions.

- Capital Erosion: The fear that your trading account will slowly (or quickly) vanish due to spreads, poor trades, or simply not knowing what you’re doing.

- Time Sink: The worry that you’ll spend countless hours learning, only to find you’re no closer to consistent results.

This pain stems from a fundamental mismatch: approaching a sophisticated, probabilistic environment with a vague hope instead of a structured, logical methodology.

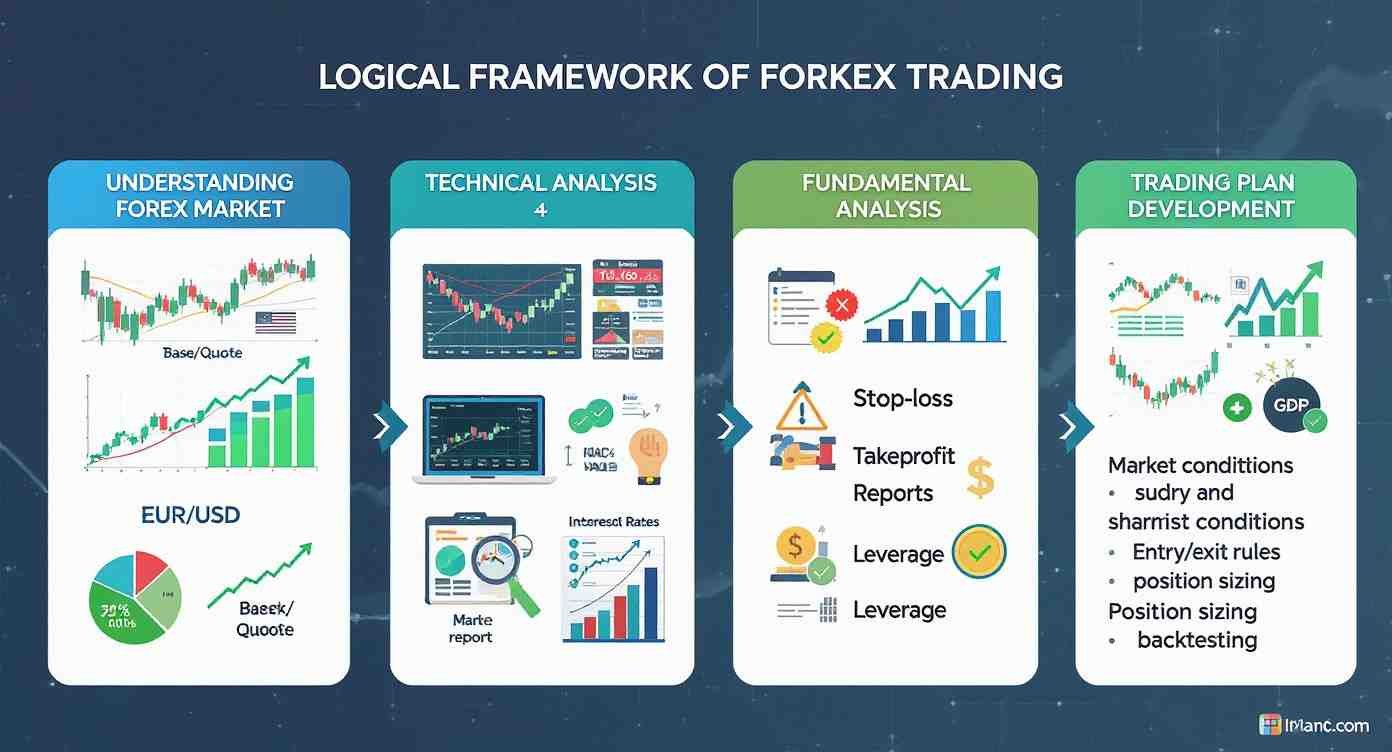

The Logic: Building Your Forex Trading Framework from the Ground Up

Successful forex trading is not gambling; it’s a probability-based business. It requires a systematic framework that removes guesswork and emotion. Here is the logical, step-by-step progression you must follow.

Understanding the Forex Market Foundation

Forex is the simultaneous buying of one currency and selling of another. These currencies are traded in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the “base,” the second is the “quote.” The price tells you how much of the quote currency you need to buy one unit of the base.

The Core Pillars of Analysis

Your trading decisions should be informed by one or both of these analytical approaches.

| Analysis Type | What It Studies | Key Tools & Indicators | Time Horizon |

|---|---|---|---|

| Technical Analysis | Historical price action and volume to forecast future movements. | Chart patterns, Support/Resistance, Moving Averages, RSI, MACD | Short to Medium-term (Minutes to Weeks) |

| Fundamental Analysis | Economic, social, and political forces that affect currency supply and demand. | Interest Rates, GDP, Inflation Reports (CPI), Employment Data, Geopolitical Events | Medium to Long-term (Days to Years) |

The Non-Negotiable: Risk Management

This is the most critical component of your logic. No strategy survives without it.

- Risk-Per-Trade: Never risk more than 1-2% of your total trading capital on a single trade.

- Stop-Loss Orders (SL): A mandatory order that automatically closes a losing trade at a predetermined level to prevent catastrophic losses.

- Take-Profit Orders (TP): An order to close a profitable trade at a specific level, locking in gains and removing emotion.

- Leverage Wisdom: Leverage (like 50:1 or 100:1) is a double-edged sword. It amplifies both gains and losses. Use it sparingly until you are highly experienced.

Developing and Testing a Trading Plan

Your trading plan is your business plan. It must be written down and include:

- Market Conditions: When will you trade? (e.g., high volatility sessions like London-New York overlap).

- Entry & Exit Rules: Precise criteria for entering a trade (trigger) and your SL/TP levels.

- Position Sizing: How many lots or units you will trade based on your risk percentage.

- Backtesting & Demo Trading: Test your plan rigorously on historical data and then in a risk-free demo account for at least 2-3 months. This is your practice runway.